Ⅰ The windfall has reached TikTok Shop, where a large number of sellers are quietly undergoing a "brand transformation."

Malaysia’s E-Commerce Market: Challenges and New Opportunities

Over the past year, Malaysia’s e-commerce market has continued to heat up. However, cross-border sellers are now facing a new wave of challenges. With rising tariffs in Europe and the U.S., coupled with increasing international logistics costs, traditional profit models and supply chain resilience are being tested like never before.

Small-scale sellers and independent website operators who rely heavily on direct shipping from China to Malaysia are seeing their profit margins squeezed. Many have responded by streamlining SKUs to cut losses or adjusting prices to mitigate cost pressures. Others are actively transforming their operations by adopting overseas warehouse solutions to improve delivery efficiency and enhance user experience.

Despite ongoing global uncertainties and unpredictable policy shifts, China’s robust manufacturing supply chain and Malaysia’s increasingly mature e-commerce ecosystem continue to provide a solid foundation for brands expanding internationally. In the future, brand building and refined operations will become key strategies for sellers to break through the bottleneck.

TikTok Shop Launches the “PEAKS Brand Growth Program”

To help sellers navigate this evolving landscape, TikTok Shop’s cross-border e-commerce platform has introduced the “PEAKS Brand Growth Program.” This comprehensive initiative offers end-to-end support—ranging from product launches and influencer collaboration to brand building and service upgrades—helping sellers evolve from simple product selling to long-term brand development.

1. Content + Traffic to Fuel Product Breakouts

In today’s market environment, low-price trial runs and high-frequency new launches are no longer effective. TikTok Shop emphasizes the use of compelling content to drive traffic. For example, local fashion brand N created a viral product line by showcasing Muslim fashion styles through short videos.

2. Influencer Collaborations to Accelerate Brand Momentum

In Malaysia, influencer marketing and livestream selling have become powerful growth drivers. Lifestyle influencer M partnered with home goods brand S, using short videos to generate buzz, resulting in a 3.5x increase in brand searches. The new TikTok Shop program encourages deeper partnerships between sellers and top creators to build brand awareness and boost conversions through high-quality content.

3. Service and Fulfillment Upgrades to Unlock Supply Chain Potential

Brand building goes beyond great products—it requires excellent service. TikTok Shop is collaborating with premium overseas warehouse providers to enhance local fulfillment capabilities. For instance, a Chinese beauty tools brand now ships from a local Malaysian warehouse, achieving delivery within 72 hours. This has significantly improved customer satisfaction and repeat purchase rates, with the store’s DSR rating soaring to 4.9 stars.

Finding Long-Term Growth Amid Change

TikTok Shop’s “PEAKS” initiative sends a clear message: future success will depend on strength in content, service, and branding. As a key Southeast Asian market, Malaysia offers strong demographic potential and a content-savvy user base. Platforms, creators, and service networks will be critical pillars supporting sellers in their brand-building journeys.

In a world of uncertainty, focusing on long-term value may be the most promising path for cross-border sellers seeking sustainable growth.

Ⅱ 67% of Lazada Sellers Say AI Significantly Drives Growth — Lazada Emerges as Southeast Asia’s E-Commerce AI Leader.

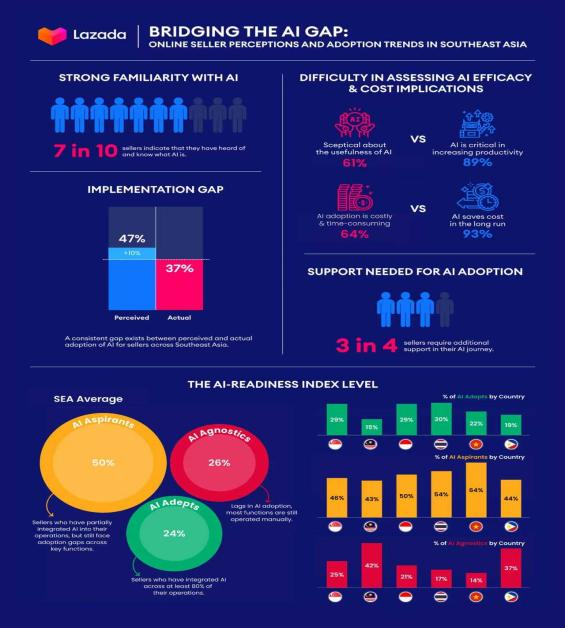

Alibaba has once again taken the lead in AI application, this time through its Southeast Asian e-commerce platform Lazada. According to a recent Southeast Asia e-commerce AI report released by the internationally recognized research institution Kantar, the overall adoption rate of AI tools among Southeast Asian merchants is less than 37%, but Lazada merchants have a much higher adoption rate. The report points out that 67% of Lazada merchants believe AI tools have significantly boosted business growth. Lazada has become the leader in e-commerce AI in Southeast Asia.

Kantar surveyed 1,214 merchants in Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam and found that there is a large gap in AI application among Southeast Asian merchants. Vietnamese and Indonesian merchants use AI much more frequently than merchants in other countries, while Thai merchants are particularly good at using AI to handle complex problems in operations.

However, the overall data shows that the AI usage rate of Southeast Asian merchants remains low; 68% of merchants say they are aware of and paying attention to AI, 47% recognize AI’s potential in work applications, but in reality, only 37% have truly integrated AI into their workflows.

Image: Kantar data shows Lazada is leading and accelerating AI adoption among Southeast Asian merchants

This reflects the current common situation among Southeast Asian merchants: most merchants realize that AI can help improve work efficiency, but due to habitual working methods, they still rely on traditional approaches and need further practical learning to use AI.

Lazada is changing this situation. As one of the first e-commerce platforms in Southeast Asia to adopt AI technology, Lazada has actively integrated AI into its core operations since its establishment. Early achievements include AI-based personalized recommendation systems, the AI image search function launched in 2019, and logistics route optimization technology.

In 2023, Lazada launched Southeast Asia’s first AI-powered customer service tool tailored for e-commerce scenarios—LazzieChat. The following year, Lazada further introduced a consumer AI solution built around generative AI technology—AI Lazzie, which includes key functions such as personalized shopping recommendations, virtual model try-on, and intelligent review summarization, aiming to enhance the consumer experience and effectively improve shopping efficiency.

To encourage more merchants to use AI, Lazada also launched a "Merchant AI Application Manual", which provides tailored guidance based on merchants' AI levels and teaches them how to use AI step by step (merchants can reply with the keyword “AI Manual” in Lazada’s official WeChat account to receive it).

In addition, Lazada took the lead in launching an AI assistant for merchants: Lazzie Seller.

Lazzie Seller is built on Lazada’s experience in e-commerce operations and uses natural language to quickly respond to various merchant operation issues, including function navigation, store risk assessment, and providing professional advice. It is equivalent to equipping each merchant with an all-around assistant to improve operational efficiency. Some merchants said: “We are happy to adopt new technologies and are willing to try various new AI features on Lazada.”

Image: Merchants are using Lazada’s AI tools to generate virtual models to showcase products

In the recent earnings analyst call, Alibaba CEO Wu Yongming emphasized that in the next three years, Alibaba will increase investment in its AI strategy, focusing on three key areas:

1.Strengthening AI and cloud infrastructure construction;

2.Developing foundational AI models and native applications;

3.Promoting AI transformation in existing businesses.

The AI progress made by Lazada is exactly the embodiment of the third focus area.

Ⅲ Shopee Malaysia Merges Preferred and Preferred+ Programs

According to Shopee Malaysia, starting from May 12, 2025, the Preferred Seller (PS) and Preferred+ Seller (PS+) programs will be merged into a single Preferred Seller program.

As a result, all Preferred+ Sellers will be transitioned to the Preferred Seller program. The Preferred+ Seller page will no longer be accessible starting May 8, 2025.

The Preferred+ Seller program will be discontinued, and all existing PS+ benefits will expire on May 12, 2025. All existing PS and PS+ sellers will be able to enjoy the benefits listed here.

This adjustment aims to provide a more structured program for sellers, thereby better supporting sales growth.

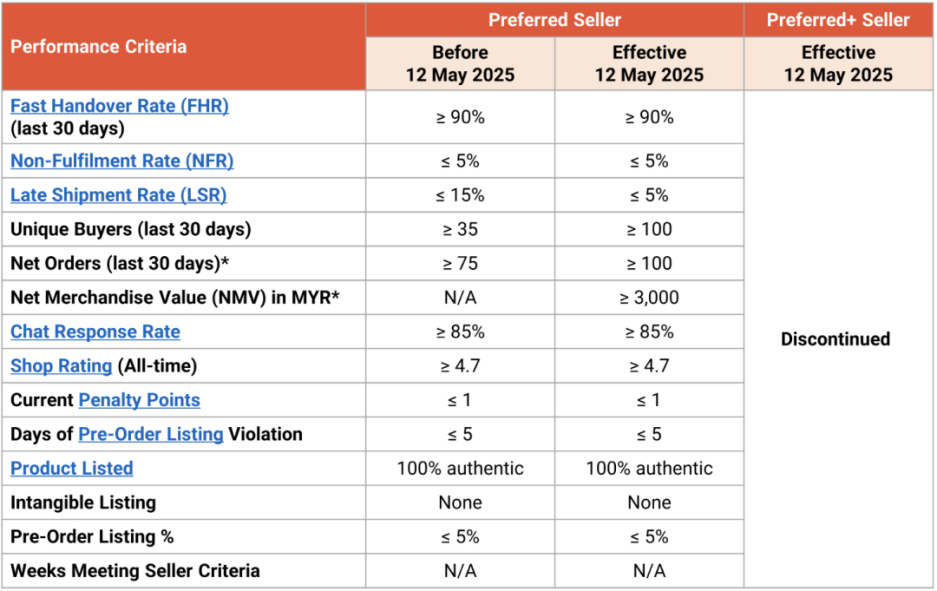

The Preferred Seller criteria will be revised according to the table below, and these criteria will now apply to all eligible sellers participating in the Preferred Seller program: